Central Banks Must Act In Opposition To Ponzi Scheme Of Crypto Currencies

Central banks must get ready to act in opposition to crypto currencies to make sure that they do not undermine trust and turn out to be entrenched in central banks, the Bank for International Settlements’ leader claimed to the media in an interview this week.

General manager for the BIS, Agustin Carstens, claimed in a statement that crypto currencies, for instance, bitcoin were most likely not sustainable as cash and became unsuccessful in the fundamental textbook meaning of being a currency. BIS is an umbrella association for the central banks in the world.

“There is a sturdy case for rule interference,” he claimed further. He added this at Goethe University of Frankfurt. “These assets can lift questions associated to investor and consumer protection. Suitable authorities have a responsibility to protect and educate consumers and investors, and require getting ready to act.” “Private digital coins camouflaged as currencies should not undermine this trust in central banks”, he claimed further. He stopped short of recommending what tangible actions must be taken.

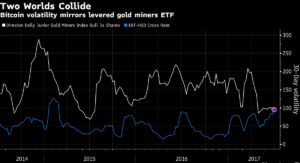

Carstens is the newest of a swing of worldwide policymakers to act out in opposition to digital currencies post their dramatic increment in 2017. Bitcoin, the best-recognized crypto currency, increased over 1,000% last year. In 2018, on the other hand, the danger of authoritarian clampdowns and bars from credit card companies to social media platforms, has already posed it to drop some 50%. Carstens defined bitcoin as a mixture of a Ponzi scheme, a bubble, and an environmental catastrophe. The previous refers to the energy-concentrated procedure of taking out the digital currency.

To avoid crypto currencies from turning out to be parasites on current economic infrastructure, Carstens claimed that only those products and exchanges that met approved measures must be given authorization to payment and banking services. “This indicates same regulation and same risk. And no exemptions permitted,” he claimed.

Be First to Comment